A Donegal priest is urging Donegal County Council to outline, in a very clear and visible way, how money raised through the Local Property Tax is spent.

This week, the council voted to retain LPT at current levels, a decision which has led to some debate.

Supporters say the LPT has not increased, opponents say each year, the tax reverts to the baseline, and the council has adopted a 15% increase, as it has every year since 2019.

Officials say the money is necessary to fund vital services, but on today’s Nine til Noon Show, Fr John Joe Duffy asked them to spell out what those services are……….

Graph presented to members at this weeks meeting –

BRIEFING DOCUMENT PRESENTED TO MEMBERS –

In July 2021, the Council’s decision to maintain the rate of LPT at +15% of the baseline had

the effect of retaining additional LPT income of €1.7 million for Budget 2022. The rate of

LPT was first varied in Donegal for Budget 2020. Retaining the increase each year since then

has allowed the Council to plan for additional annual expenditure of €1.7 million. This

additional income was deliberated upon in the making of Budget 2022 and allowed for the

following:

1. €500,000 was ring-fenced to provide capacity to co-finance the Council’s capital

programme. During 2022, the Council sought approval for the drawing down of loan

financing in the sum of €20 million. €16m of loan financing has since been drawn

down and is repayable on a fixed-rate basis over 20 years. The Council is committed

to annual repayments of approximately €1.2 million and this expenditure must be

budgeted for on a first-call basis each year. The requirement for the Council to source

additional co-financing of at least a further €25 million to co-fund existing capital

projects and projects being applied for has been widely discussed.

2. €500,000 was included as a repeat provision for additional expenditure on housing

maintenance. Since 2020, this additional annual expenditure has been beneficial for

tenants and has resulted in significant improvements to our housing stock. There is a

desire to have this extra maintenance level repeated each year and as such there will

be a need to repeat the provision each year.

3. €500,000 has been included to replace the diminishing income from NPPR charges

which will be phased out completely by 2025. If this shortfall was not provided for

under this heading, it would have had to be taken from the general budget and have

the consequent impact of reducing the money for something else.

4. €259,000 was included as a repeat provision under the “Public Lights and Minor

Infrastructure Fund” (equivalent to €7,000 per elected member). The procedure for

draw-down has been finalised through the SPC process. Monies not spent will be

carried over into 2023. It is hoped to provide a further €259,000 for this purpose in the

Budget for 2023, circumstances permitting, and this will offer a good economy of

scale by facilitating worthwhile improvements across many towns and villages and

Council Housing Estates.

III. CAPITAL PROJECTS

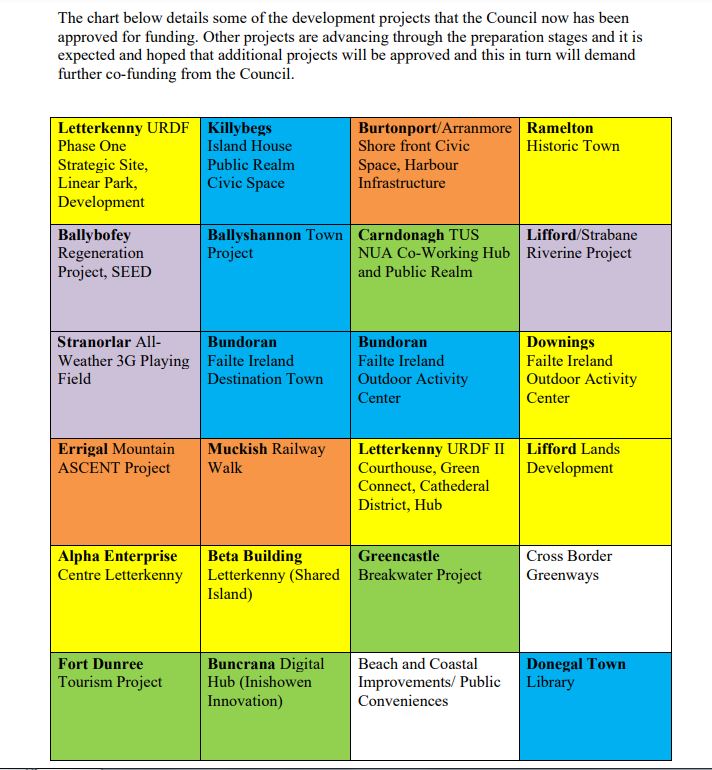

The Council has an extensive range of projects that have been approved for Capital Funding

from a number of sources including Government Departments, State Agencies and Cross

Border Entities. Updates have been provided previously at various meetings and workshops.

In many cases, the projects have significant involvement from Local Communities, Partner

Agencies at Local & Regional Level and in some cases, have a significant cross-border

element.

The value of projects for which approvals are in place and are in the various stages of

delivery is in the range of €200m to €250m. The co-funding element of these projects is in

the range of €50m to €60m. The Council has approved the raising of a €20m loan in 2022

and €16m is already drawn down and being paid for based on sustaining the LPT amount for

20 years.

The massive inflation in construction costs will result in the out-turn for these projects being

much higher than the costs estimated at the initial application stage.

In addition, there are many other worthwhile projects presenting and being considered for

development over the coming years all across the County. The value of these projects

(excluding the €0.5 billion TEN-T Improvement Works) is in the region of €100m. Projects

of this value will require a match funding contribution in the region of €20 to €25m

depending on the co-funding component.

The projects that the Council have been working on include a wide range of activities across

all five Municipal Districts. These projects are periodically reported on at Municipal District

level and some of them are listed below:

1. Greencastle Pier Extension & possible Cruise Berth (Breakwater tendered in Summer

2022)

2. Letterkenny Leck Road & Swilly Relief Road

3. Aghilly Road, Buncrana

4. Donegal Town, One way system / Traffic Management

5. Backlane, Ballybofey Projects & Town Roads

6. Pluvial Study in Twin Towns

7. Dunfanaghy Carpark (Construction complete)

8. Burtonport / Arranmore Project (Arranmore complete – Burtonport underway)

9. Inver Slipway

10. Carrigart to Downings Walkway

11. Rathmullan Pier Rehabilitation (Tender under preparation)

12. Leisure Centre Buncrana

13. Riverine Project, Lifford

14. Island House Project, Killybegs (Construction to begin shortly)

15. Electric Vehicle Charging Stations

16. Housing Capital Programme across all MD areas

17. Upgrade of Public Lighting

18. Countywide Programme of Footpath upgrades

19. Round 2 Town and Village Measures in Dungloe, Donegal Town, Clonmany, Glen and

Carrigart.

20. Town and Village Renewal in Carrick, Bruckless, Ardara, Fintown, Churchill,

Downings, Convoy, Crossroads, Buncrana and Moville.

21. Further Upgrade of Lifford Army Barracks and new Access Route to Town Centre

22. Failte Ireland projects in Fort Dunree, Rathmullan Battery, Ballyshannon Workhouse,

Glenties at The Laurels and Letterkenny Courthouse.

23. Digital Hub Programme

24. Portsalon Pier

25. Tourism Projects including Malin Head, Errigal, Gweedore.

26. Range of Greenways Projects and Active Travel

27. Climate Change and Energy Projects

28. Swan Park, Buncrana (Construction complete)

29. Letterkenny URDF (Linear Park under construction)

30. Series of Shared Island Projects

IV. SUMMARY

The success of the Council’s strategic investment programme will be critically reliant on the

extent of own-resource funding available to co-fund projects such as those listed above. If

sufficient co-financing is not available, the Council will need to limit the scale of its ambition

– something that Council staff, management and members do not want to countenance given

the potential of our northwest region and the unique opportunities presenting at this point in

our history.

Creating the capacity to co-fund the Council’s ambitious programme of capital

investment is a crucial strategic objective in the years ahead.

The Council’s investment programme will generate substantial knock-on benefits in terms of

economic development, job creation and population growth in the years ahead – with the

potential to create social and economic benefits that will be deep and lasting.

The Council, as the leading local development agent, will continue to have a critical role to

play in the future of Donegal. It is very important that the Council is in a position to respond

to the development needs of the county and to be able to participate and gain the maximum

benefits arising from the programme of funding applications sought by central government

over the year.

The decision on the Local Property Tax is a first step towards the making of a budget and

work programme for 2023 and it is most important that the Council not worsen its position on

the LPT fund and maintain the same level for 2023 as was achieved for 2022. This means

holding the amount at the base figure plus the 15% in line with the decision taken last year.