Finance Minister Michael McGrath says he plans to amend the forthcoming Finance Bill to exclude the value of pouring concrete used in precast products from the scope of the Defective Concrete Blocks Levy.

Minister McGrath says this will come in to effect on January 2024 1st next, with a refund scheme to be introduced.

He says concrete blocks and pouring concrete for use other than in precast products will remain within scope of the levy, which came into effect on Friday.

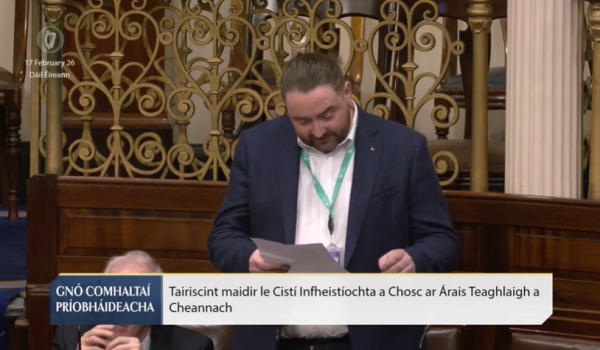

The decision has been welcomed by the IFA, while Donegal TD and Sinn Fein Finance Spokesperson Pearse Doherty has called for the levy to be scrapped, calling it “a tax on new homes”.

**********************

Statement in full –

Minister McGrath confirms changes to Defective Concrete Products Levy in relation to precast products

Published on

Last updated on

The Minister for Finance, Michael McGrath has today announced his intention to bring forward a legislative amendment in the forthcoming Finance Bill to deal with how the Defective Concrete Products Levy (DCPL) impacts on the sale of certain precast products.

Minister McGrath commented:

“The Defective Concrete Products Levy (DCPL) is intended to ensure a contribution by the construction sector towards the cost of the Mica Redress Scheme.

A limited number of precast products had originally been listed as being within scope of the levy when it was announced in October 2022.

Following further consideration, these were removed prior to the publication of what became Finance Act 2022. The legislation provided that while such products would not be within scope of the DCPL, the pouring concrete element which forms a constituent part of precast concrete products is within scope. This is reflected in Section 99 of the Act as passed by the Oireachtas.

My officials have held a series of meetings with industry bodies where they outlined their concerns about this aspect of the application of the levy. It has become clear that the manner in which the levy impacts on the sale of certain precast products has a potentially negative impact on the export of these products and competition from suppliers in to the jurisdiction.

It is my intention to bring forward an amendment in the forthcoming Finance Bill to exclude the value of pouring concrete used in precast products from the scope of the levy. This will come in to effect on 1 January 2024 and a refund scheme will apply for the interim period to the end of 2023. Concrete blocks and pouring concrete for use other than in precast products will remain within scope of the DCPL.

It is my belief that, taking account of the proposed amendment, the overall design of the levy balances the need to ensure some of the costs of the redress scheme are met from a source other than the Exchequer, while limiting the impact on inflation in the construction sector.

The Department of Finance will, with Revenue’s assistance, closely monitor the introduction and operation of the DCPL and will continue to engage with industry to identify ways to address any issues that arise.”