Auctioneer, and valuer members of the Society of Chartered Surveyors Ireland are forecasting that the price of agricultural land nationally will increase by an average of 8% this year.

The prediction is contained in the latest SCSI/Teagasc Agricultural Land Market Review and Outlook Report, which has just been published.

The report finds that last year, for holdings of under 50 acres, good quality land in Donegal was the highest in Connaught Ulster.

In Connacht / Ulster, the average price for good land on holdings under 50 acres range in Donegal last year was €12,143 per acre, the highest in the region. That’s down from €13,375 in 2021.

The lowest price was registered in Leitrim, at €6,140.

Mayo had the second highest price for good quality land, while Roscommon was third.

Prices for poor quality land on similar sized holdings ranged from an average of €5,375 in Galway to €3,300, in Leitrim. The average price in Donegal was €3,786.

It’s its commentary on current agricultural markets, Teagasc says while the increased cost of many key inputs was a major concern throughout 2022, these were counterbalanced by record milk prices and by significantly higher grain and meat prices. Looking ahead, they suggest the margins on milk and sheep will decline in the coming year, while prices for beef and pork are forecast to be higher.

The full report can be read HERE

SCSI Press Release in full –

SCSI/Teagasc Agricultural Land Market Review and Outlook Report 2023

§ National farmland prices forecast to rise by 8% on average in 2023

§ Donegal has the most expensive land in Connacht / Ulster

§ Prices in the county ranged from €3,786 for an acre of poor-quality land to €12,143 for good quality

Thursday 27th April 2023. SCSI auctioneers and valuers are forecasting that the price of agricultural land nationally will increase by 8% on average this year, underpinned by a strong dairy sector. In a major new survey, auctioneer, and valuer members of the Society of Chartered Surveyors Ireland (SCSI), operating in the agricultural and rental markets say they expect national rental prices to increase at an even higher rate – an average of 14%.

They say prices will be driven by the constrained supply of land for rental and higher anticipated demand, particularly from the dairy sector due to new environmental regulations. However, experts from Teagasc note that milk prices have fallen back somewhat this year. National average non-residential farmland prices in 2022 ranged from €5,564 per acre for poor quality land – up 5% from €5,308 in 2021 – to €11,172 per acre for good quality land – up 2% from €10,962 the previous year.

In Connacht / Ulster, average prices for good land on holdings under 50 acres range from a €12,143 per acre in Donegal – down from €13,375 in 2021 but still the highest in the region – to €6,140 in Leitrim, up from €5,025 in the last survey. Mayo had the second highest on €10,092 while Roscommon was third on €9,938.

Prices for poor quality land ranged from an average of €5,375 in Galway to €3,300, in Leitrim, the cheapest in Connacht / Ulster on holdings under 50 acres. The average price for an acre of poor land on this holding size in Donegal is €3,786. However, the land with the lowest value in the country is poor quality land in Mayo where the average price across all holdings is €2,866 per acre.

According to the Society of Chartered Surveyors Ireland / Teagasc Agricultural Land Market Review and Outlook Report 2023, the Central Statistics Office data shows that the share of agricultural land, which transacts for sale annually is only around 0.5% and this is one of the main reasons for the strong agricultural land letting market which exists here.

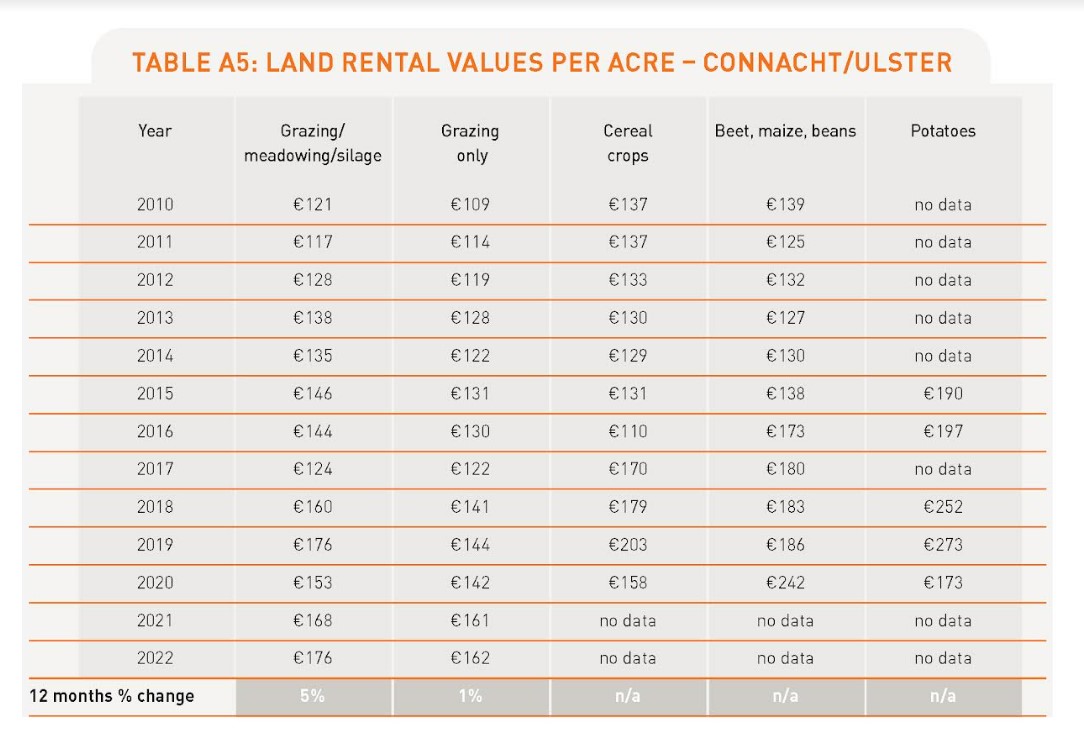

In Munster, where land rental values increased on average by 13% last year, prices per acre ranged from €241 for grazing only to €383 for potato crops. In Leinster, rental values increased on average by 9% and ranged from €248 for grazing only to €439 for potatoes. In Connacht / Ulster, land for grazing, meadowing and silage increased by 5% to €176 per acre and for grazing only by 1% to €162.

According to the survey of 134 auctioneers and valuers from all over the country, the volume of land sold last year was similar to 2021, with executor / probate sales providing the main source of farmland sales.

Prices around the country

This year’s annual survey, the tenth in the series, provides a county-by-county breakdown on the prices of good and poor-quality land. (See attached County by County Map of Ireland and Provincial Tables for detailed breakdown of figures across land type and holding size) The survey found the most expensive land in the country is in Kildare with good quality land across different plot sizes fetching an average of €15,056 per acre.

According to this year’s survey, after Kildare, the next most expensive land is in Meath and Waterford. The average price of good quality land on holdings of less than 50 acres in Kildare is €15,333 per acre, followed by Meath on €15,200 and Waterford on €15,000. Tipperary on €14,938, Wexford on €14,857 and Carlow and Cork on €14,250 round off the top six places.

In Leinster prices for good land in 2022 on holdings of less than 50 acres range from Kildare’s high of €15,333 – which is similar to the previous year – to €11,500 in Offaly, while the prices for poor quality land range from a high of €9,417 in Louth to €6,000 in Longford. In Munster, prices for good land on holdings under 50 acres range from Waterford’s €15,000 to €8,813 in Clare. Prices for poor quality land ranged from an average of €7,750 in Cork to €4,125, in Clare. Interestingly Waterford recorded the single highest price per acre in one plot size, with good quality land on plots between 50 to 100 acres going for €17,400 per acre.

Land Market Commentary

Chartered Valuation Surveyor Cormac Meehan, of Sean Meehan & Co in Bundoran says strong demand for good quality land from dairy farmers is driving the market.

“Eighty-three per-cent of agents in our survey believe there is likely to be an increase in demand from dairy farmers to purchase farmland in 2023 and they are continually ranked throughout the survey as being the most likely purchasers of land across the country. However, as outlined in this report it’s also likely that changes to the European Nitrates Directive, particularly measures aimed at protecting water quality will have an impact on land prices, especially rental prices.”

“In order to maintain current levels of milk production – and to comply with the directive – many dairy farms will need to either increase their land area or reduce milk production. We’d expect the impact on sales and rental prices will be more acute in regions where dairy is the dominant farm enterprise and where stocking rates are higher.”

“Last year was also a good year for tillage farmers and Leinster based auctioneers and valuers say demand for good arable land or land close to any sizeable dairy farms attracted strong interest and competitive bidding. That demand is also reflected in strong price growth in the dairy heartland of Munster where agents say one of the main drivers of the market was a heightened interest from individuals with their own funds looking to invest in land and guard against the effects of general inflation. While land prices are lower in Connacht / Ulster, the region recorded the biggest increase in prices for good quality land and is forecast to do so again this year.”

“Provincially, rental values are expected to increase the most in Munster – 17%, followed by Leinster on 15% and Connacht/Ulster on 10%. Approximately 88% of agents expect the volume of farmland available for lease this year will either remain the same or increase, up from 62% last year and this is positive for the market given the constrained land supply situation” Mr Meehan said.

Agricultural Outlook

Teagasc economist Dr. Jason Loughrey said Russia’s invasion of Ukraine is continuing to have a major impact on agricultural markets, at both international and domestic levels.

“As in many other countries the invasion resulted in higher energy and fertiliser prices for farmers here in Ireland, and these have remained at elevated levels despite some modest declines in recent months. The increased cost of many key inputs was a major concern throughout 2022 but these were counterbalanced by record milk prices and by significantly higher grain and meat prices.”

“However, the price output picture this year is more difficult. For example, milk prices have declined from their record levels and while still high by historical standards, the average net margin per litre is set to fall below 15 cent this year. While a modest overall increase in milk production is forecast, recent changes to the Nitrates Directive will limit the extent of any growth.”

“On the other hand, prices for beef and pork are forecast to be higher compared to last year with margins and incomes on cattle rearing farms predicted to rise significantly this year. However, the margins on sheep farms are expected to decline this year while the outlook for tillage farms also appears difficult with futures markets indicating significant declines in output prices at harvest time. Based on those projections, the expectation is that cereal based net margins will be negative on approximately 50% of specialist tillage farms this year.”

“Crop prices increased significantly in 2022 with an almost 50 per cent increase in the average net margin per hectare for tillage farmers. Rental prices increased strongly in Munster and Leinster in the case of land suitable for cereal crops. Despite a difficult short-term outlook for the sector, it is expected that the competition for rented land will further increase land rental prices for tillage farmers in 2023’.

“Our analysis indicates that the impact of the banding policy on the agricultural land rental market could be highly dependent on the farming structures in a locality. Approximately one-fifth of all dairy farms operate in the highest banding category and this is where much of the additional demand for rented land is currently emerging. The effects on land rental prices could be very location-specific. Localities with a high density of farms in the highest banding category are likely to experience a larger increase in rental prices than elsewhere” Dr. Loughrey concluded.

The full report is available at www.scsi.ie