Donegal County Council is debating hat the level of Local Property Tax should be in 2022, with officials recommending that the tax remain the same as this year, effectively maintaining a 15% increase.

Finance Director Richard Gibson and Chief Executive John McLaughlin both warned any reduction in the council’s income from LPT would have an impact on its ability to deliver services.

Chief Executive John McLaughlin said it’s anticipated that a more certain financial picture will emerge in advance of presenting a draft budget in November 2021.

He said the underlying conclusion of the council’s considerations is that there is a need to retain an equivalent level of Local Property Tax income in 2022 in order to provide the Council with the necessary scope to draft a balanced revenue budget and to support the

Council’s strategic objectives.

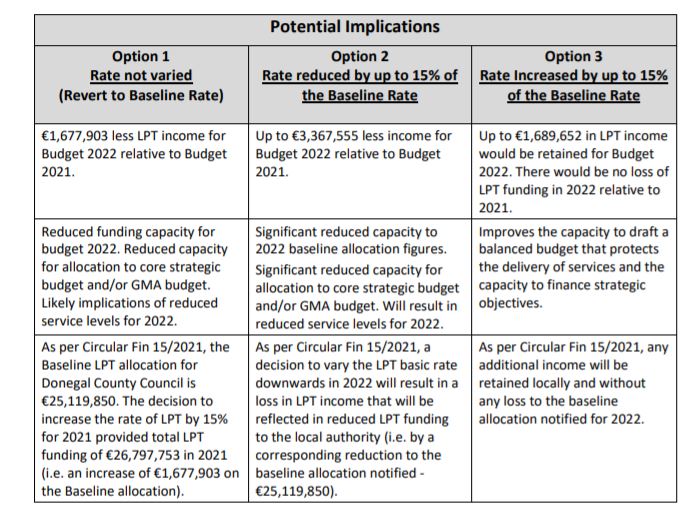

Mr McLaughlin said a decision not to vary the rate would result in a loss of LPT income in the sum of almost €1.7 million, while a decision to reduce the rate would see income fall by nearly €3.4 million.

He concluded said it’s important that the Council be in a position to have funding in place in order to enable the authority to be part of the post Covid recovery of society, and that means retaining the 15% increase.

***********************

Options presented to members –

In summary:

• Donegal County Council may resolve to vary the base rate of LPT by up to +/-15%.

• The effect of varying the base rate would result in an income variance of up to

+/-€1.690m from the Baseline allocation of €25,119,850.

• A decision not to vary the rate would result in a loss of LPT income in the sum of

€1.678m for Budget 2022 relative to Budget 2021.

• A decision to vary the rate upwards by up to 15% would see the resultant gain in

income being retained by Donegal County Council in its entirety and without

reduction to the baseline allocation of €25,119,850. The emerging challenges

presenting in preparing the draft revenue budget for 2022 indicate a requirement

for the increase in LPT funding to be retained in order to protect services and to

protect the capacity to finance strategic objectives.

• A decision to vary the rate downwards would see the resultant loss in income

being reflected by a reduction in the LPT funding to the Council, i.e. a reduction

by an equivalent amount from the baseline allocation of €25,119,850. A decision

to reduce the rate of LPT by up to 15% would see a loss in income of up to

€3.368m for Budget 2022 relative to Budget 2021.